What should you be doing to get ahead while interest rates are low?

I’m often asked by clients what they should be doing to get ahead, as with most things in life the simpler the strategy the more effective it often it. The strategies I’ll touch on over the next few weeks are just that, but in times of low interest rates they’re easier to implement and can have a powerful impact on your long term position.

It probably doesn’t feel like it anymore, because it’s been this way for some time, but interest rates are really low! Home loan rates in the High 3%’s or very low 4%’s are at around 60% of the long term average. Credit card rates are still criminal at around 20%, but more about that later.

The first strategy is a really simple one: don’t pay more interest than you need to!

Once you have a strategy and have identified the loan structure and products that will best help you achieve your long term goals, make sure you’re not paying over the odds. If your home loan doesn’t sound start with a 3 (or a very low 4 depending on your circumstances), let us help you research a better one!

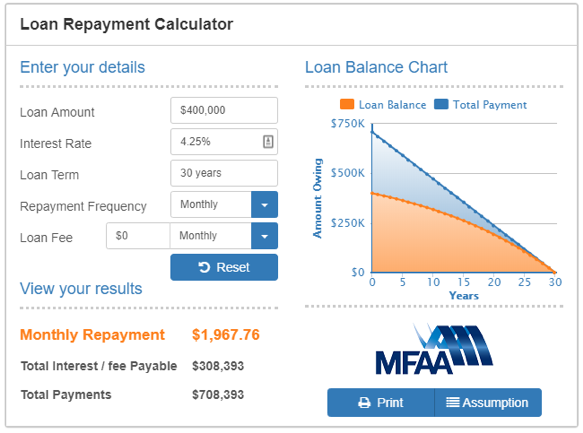

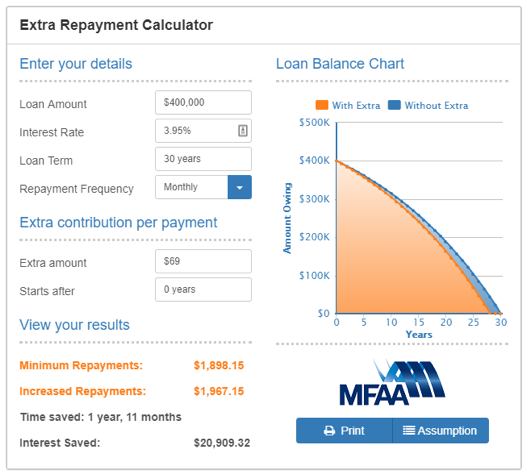

As the calculations below show, paying 4.25% when you could be paying 3.95% will cost you an extra $ 25 059 over the term of your loan, which equates to almost 2 years of extra repayments you may not need to be making.</>

Loan repayments at 4.25% over 30 years:

With refinance to a lower rate of 3.95% and keeping the same monthly repayments as before, you’ll save $25k and almost 2 years off the loan:

If you want to run these numbers for your mortgage, visit www.affinitasfinance.com.au/calculators.

A word of warning in terms of rate shopping though, it’s important to compare all aspects of the loan, how it fits with your strategy and any hidden costs or post settlement inflexibility (which can be very expensive), rather than just chasing the cheapest rate. Think super cheap airline tickets, except your home loan will be a much longer journey.

Also be careful of lenders looking to “buy business” with very low headline rates, we do often see an increase in a lender’s standard variable rate following one of these campaigns which can leave you back where you started, or worse off.

Managing rate creep

Once you have a competitive home loan, it’s important to keep it competitive. Rate creep is where banks make a fortune off borrowers. You’ll have noticed that when the RBA lifts rates, the banks are very quick to pass on the increases, but when they drop, there can be a substantial time lag before rates drop. Often the banks won’t match the RBA reduction and in recent months we’ve had the return of the out of cycle rate increase where the banks cite international funding pressures as the reason for increasing their standard variable rate when the RBA have made no change. At the same time they will often offer larger discounts to new customers to remain competitive.

Over time this means that your rate in comparison to what a new borrower is offered will gradually creep up. This is why we renegotiate rates for our clients on an annual basis. Where lenders come to the party our client gets the benefit of a greater savings, just this financial year we’ve saved our customers around $63 000 a year in interest by renegotiating their existing loans.

The bank’s won’t always budge and where the bank won’t meet the market, we can look into other lenders offerings to see if you would be better off moving to a new lender to be their new customer.

With the coverage of the Royal Commission and the tightening of lending standards, many people have assumed refinancing to get a better deal is too hard at the moment. Your existing bank is likely counting on this, let’s not buy into it.

We’ve had a lot of success in helping clients into structures that work better for them and achieving some great savings.