Has Netflix got you wanting to tidy up your day to day finances?

Make a start with these 3 easy steps.

I don’t know about you, but holding a bill that needs to be paid has never sparked joy for me! That said, grabbing a pile of bills, thanking them and gently placing them in the trash Marie Kondo-style probably won’t bring you any kind of lasting joy either.

Below are three simple steps for you to use to tidy up your day to day finances that will help you take control. In an hour or two you can set yourself up with a system for paying bills that will spark some joy.

Step 1: Understand your cashflow cycle

This is the equivalent of piling all your clothes on the bed and evaluating what’s there.

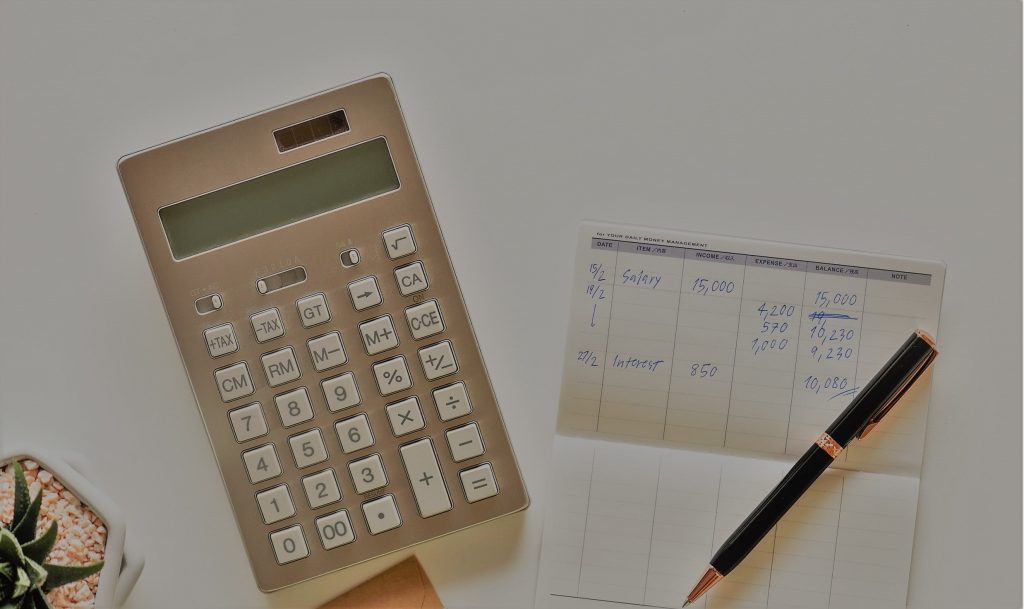

Do this by printing off 3 months’ of bank statements and grabbing a couple of highlighters. Mark off all the bills that need to be paid in different colours according to timeliness. Annual bills get their own colour, so do bi-annual, quarterly and monthly, etc.

Step 2: Have a Marie Kondo moment with your bills and then evaluate what’s left

Run your eye down the highlighted expenses and consider ditching the ones that aren’t giving you bang for buck. If you have Apple Music and Spotify or Netflix and Stan, see if you can ditch one of them. Make a note for later of the ones that are worth reviewing to look for some savings.

Once you’ve done this, make a quick list of each category (noting the approximate dates during the year they are due) and work out how much each bill comes to annually. Then total them up.

Divide this total by the number of pay cycles you have in a year (eg. 26 for fortnightly pays), round it up to the nearest $10, and you have your pay cycle bill amount.

Step 3: Automate as much as you can

Open a separate bills account. If you have a home loan, this bills account should ideally be an offset account.

Set up an automatic transfer equal to your pay cycle bills amount from your pay account into the bills account for the day after your pay arrives.

Automate the payment of as many bills as you can using direct debits set up to come out of the bills account. For those where this isn’t practical, set recurring reminders for a few days before they are due.

A word of caution: you may need to start the bills account with a bit of a buffer to make sure none of your direct debits bounce in the early days while you’re building up a balance. You will also need to keep an eye on this account, referring back to the list you made in step 2 of what’s due when, to make sure you have enough money in the account. Once you’ve had the system in place for a while you’ll need to do this less and less often.

There is more you can do in terms of comprehensive budgeting, managing day to day expenses and automating your savings too, but the three steps above will get you off to a good start

If you are wanting to take it a step further, you can access our handy family budget template here.